Key economic releases last week

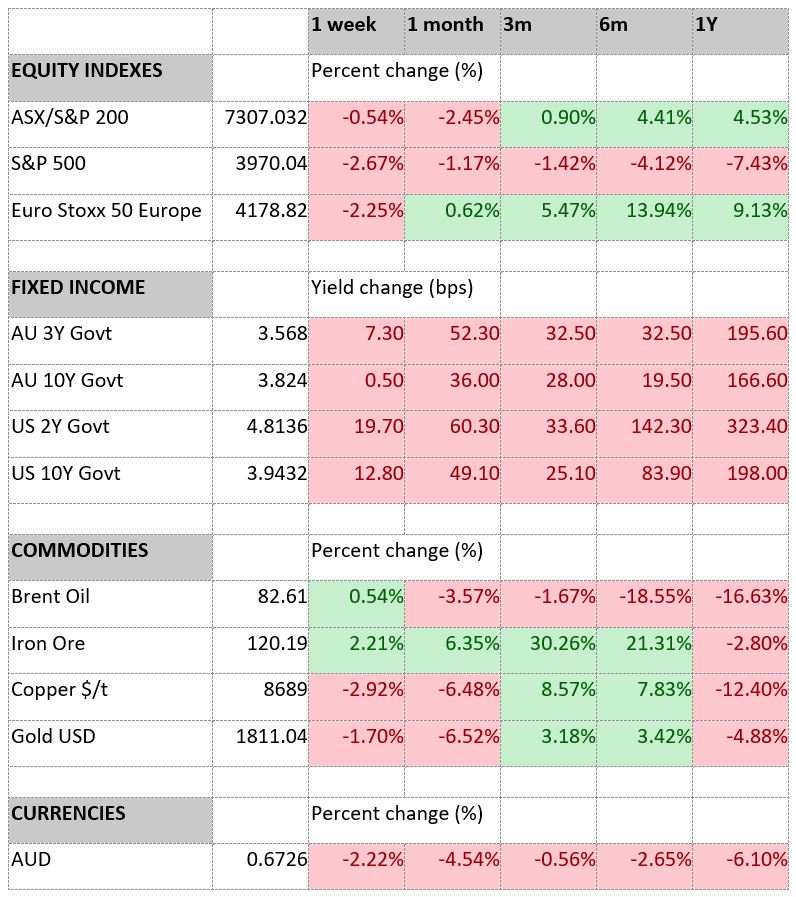

- US PCE readings were higher than expected as the core MoM reading rose 0.6% against a 0.4% consensus. This indicates that inflation remains a problem and a Fed pivot is unlikely to happen in the near term.

- US personal spending rose 1.8% in January, compared to expectations for 1.3%, indicating that consumers continue to spend.

- US Q4 GDP estimate was revised lower from 2.9% to 2.7%.

- EU inflation data was in-line, with the core reading falling 0.8% MoM and the headline reading falling 0.2% MoM.

Key releases for the week ahead

- Australian retail sales

- Australian Q4 GDP

- US consumer confidence

- US, EU, Aus and China PMIs

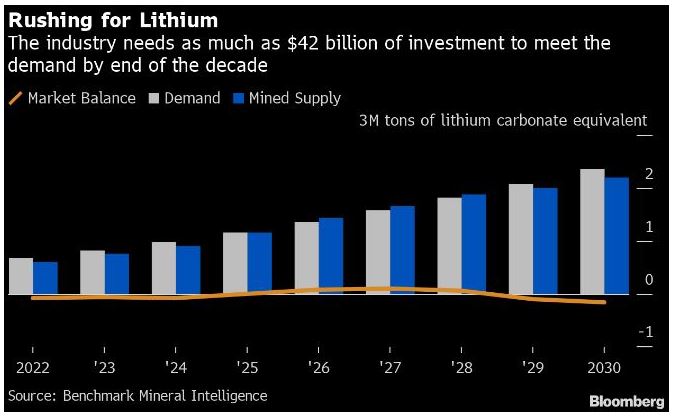

Chart of the week

Lithium has huge investor interest but is one of the more volatile areas of the market as the large increase in demand for lithium batteries is still in its early stages. Lithium resources are ample, but mines and refineries have long lead times and many risks between discovery to becoming operational, making lithium prices difficult to estimate. While lithium prices are currently high and miners are printing cash, expectations are for prices to moderate as significant supply comes on over the next few years while demand growth moderates. As the chart above shows, the lithium market is seeing a period of undersupply currently, boosting lithium prices, but is set to switch into oversupply by the middle of this decade. However, significant investment in supply is needed to boost demand towards the end of this decade. This presents opportunities and risks for investors, some directly via lithium miners, and others may look upstream into implications for mining services and equipment, or downstream into battery makers and electric vehicle makers.

–

Monday 27 February 2023, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.