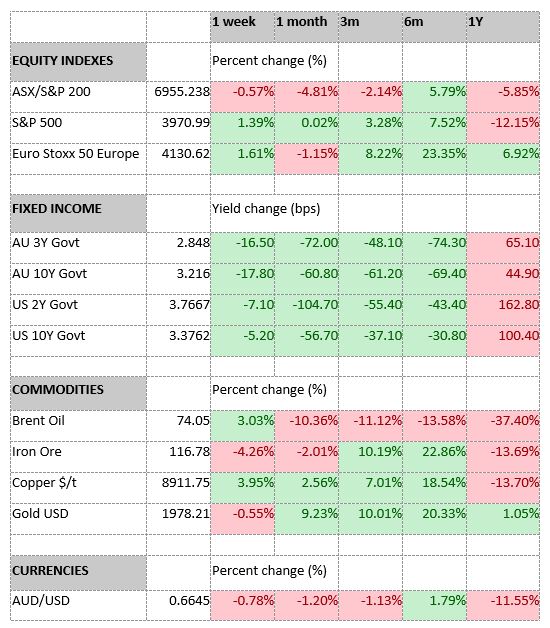

Key economic releases last week

- PBoC held policy rates steady as expected

- Fed hiked rates by 0.25% and maintained its interest rate expectations for 2023. Powell said the FOMC had considered pausing and warned that recent developments may create tighter credit conditions but noted that he will continue to hike if necessary.

- US housing data was stronger than expected as activity looks to be rebounding as mortgage rates are coming down from recent highs.

- Australian preliminary PMIs showed significant weakening into contractionary territory. In contrast, both US and EU readings saw strong services readings that continues to highlight resilient consumers.

Key releases for the week ahead

- Australian preliminary retail sales

- US consumer confidence and consumer spending

- US personal consumption expenditure

- China PMIs

- EU preliminary CPI

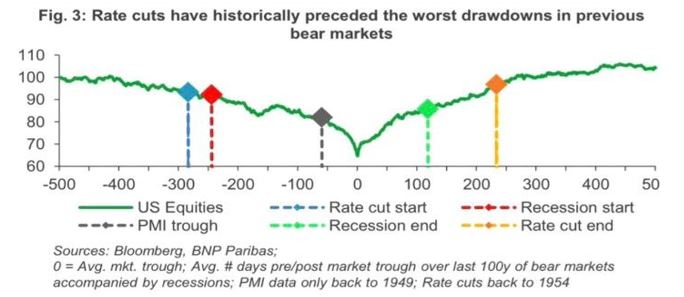

Chart of the week

The US Federal Reserve hiked interest rates by 0.25% and signalled a willingness to continue hiking last week despite the issues in the banking sector. It remains a fast-evolving situation and is therefore difficult to ascertain if there are indeed further hikes or a quick pivot to easing in the coming months. However, history has shown that, on average, equities bottom only well after cuts start. Furthermore, the greater portion of drawdowns only occur after the rate cut cycle has started. As a result, we continue to remain cautious despite the resilience of equities in the face of the recent bank failures.

–

Monday 27 March 2023, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.