Key economic releases last week

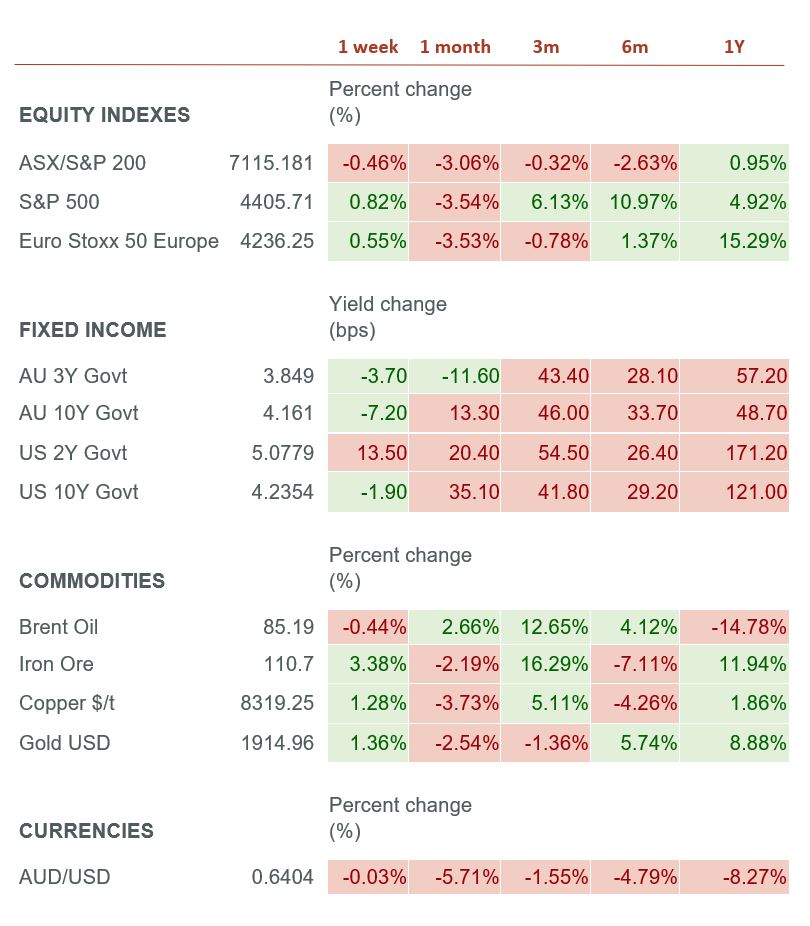

- The preliminary PMI data for Australia, the EU, and the US were largely below expectations. Manufacturing readings for all three economies fell below the critical threshold of 50, indicating contraction. Among these economies, only the US services reading crossed the 50 mark, but it remained below the anticipated consensus figures. These observations collectively underscore a global economy that is currently undergoing a weakening trend rather than showing signs of strengthening.

- The latest US housing data shows that while sales of existing homes are moving slowly, sales of new homes are remaining steady. In the US, it’s typical to secure mortgage rates for a 30-year period, and right now, the average rate being paid across existing mortgages is 3.6%. This rate is significantly lower than the present rate of 7.15% for new mortgages. As a result, existing homeowners have little incentive to sell their existing home as it will lead to steep rise in mortgage repayments. The People’s Bank of China (PBoC) reduced its one-year loan prime rate by 0.10 percentage points to 3.45%, while keeping its five-year rate unchanged at 4.2%. The general expectation among experts was for a 0.15 percentage points reduction for both rates.

Key releases for the week ahead

- Australian monthly CPI indicator

- US job data

- Chinese PMIs

- Australian retail sales

Charts of the week

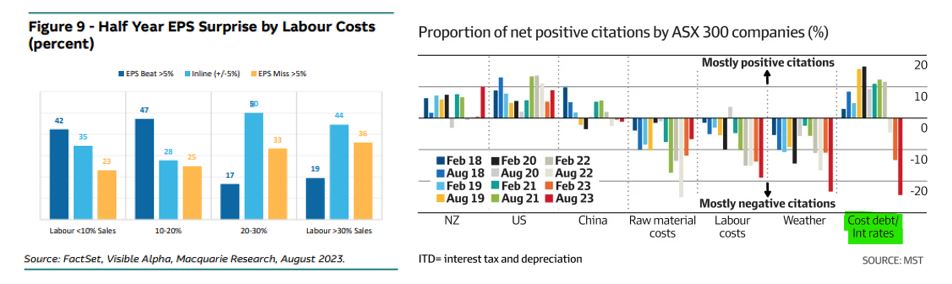

Two key themes of reporting season are higher labour costs and rising debt costs.

The first chart prepared by Macquarie divides ASX companies into quartiles based on their labour costs relative to their sales. Notably, companies with higher labour costs in relation to their revenue were more prone to falling short of consensus EPS estimates. This suggests that the market had underestimated the impact of the rising labour expenses. Given the current condition of the Australian labour market, which remains tight with early indications of weakening, it’s likely that employee costs will continue to rise into the next fiscal year, and this might lead to further reductions in projected margins for companies heavily reliant on labour.

The second chart sourced from the AFR/MST shows that rising debt costs have been a key theme for ASX300 companies that have reported so far. We have seen companies who have guided to higher interest debt costs in FY24 than anticipated get punished by the market. With bond markets predicting that interest rates are likely to stay higher for longer, the market will be more focused on leverage, debt hedging, and debt maturities in the coming years.

As we revise our financial models based on the insights from this reporting season, two key areas of focus are employee costs and debt expenses as we strive to better understand and predict the financial performance of companies within our coverage and seek to identify risks and potential mispricing opportunities.

–

Monday 28 August 2023, 3.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.