The Australian S&P/ASX 200 Index finished the week down 0.8%, with small companies outperforming large companies with the Small Ordinaries Index rising 0.5%. Technology was the best performing sector (+3.1%) supported by lower 10-year bond yields, with Financials (-2.66%) and Healthcare the worst performing sectors (-4.3%).

In the US, the S&P 500 outperformed closing 2.5% higher, closing at an all-time high, as Jerome Powell soothed investor nerves by reaffirming the US Fed’s intent is to encourage a broad and inclusive recovery of the job market and not to raise interest rates too quickly. Global equities as measured by the MSCI World also rose by over 2%.

Economic news remains supportive of equity markets. Australian preliminary PMIs for June were -1.9points to a still strong 56.1. This is still positive but supports the view that the initial rebound growth has peaked and is slowing to more sustainable levels. Eurozone preliminary PMIs were very strong as reopening boosted services. US preliminary PMIs also remained elevated.

US President Joe Biden announced he had reached a tentative deal with a group of Republican senators on the framework for a bipartisan infrastructure bill of US$559 billion. The focus of the bill will be on physical infrastructure assets including investments in the electrical grid, transit, roads and bridges amongst other forms of infrastructure. Importantly for equities, the bill is expected to be funded by a crackdown on high income earners and unused COVID relief funds, rather than raising corporate tax rates, which is supportive to valuations.

Base metals rose supporting Australian miners with China’s release of national stockpiles slower than markets had anticipated. We will continue to monitor any Chinese government interventions that aim to suppress rampant commodity prices but feel that the current demand for commodities is global in nature, suggesting the Chinese government may have limited success.

In corporate news, Woolworths (WOW) followed Coles (COL) announcing increased investment for a new distribution centre which is expected to cost $400m.

Boral (BLD) are selling their US business for USD$2.15B, a price that exceeded analyst expectations. Speaking of Boral, Kerry Stoke’s Seven Group (SVW) have upped the ante of their takeover offer, increasing their offer price to above market.

Commonwealth Bank (CBA) sold CommInsure to Hollard Group for $625m + deferred payments in order to focus on their core business.

For the week ahead, US consumer confidence, Chinese PMIs and European CPI are due to be released. For Australia May private sector credit and trade balance data will also be released.

Looking forward

Jerome Powell soothed investor nerves this week by maintaining his narrative that inflation will prove to be transitory and that the Fed will ensure that there is a broad recovery in the labour market before raising rates. This narrative was supported when US personal consumption expenditure, a monthly measure of inflation, was below consensus estimates on Friday.

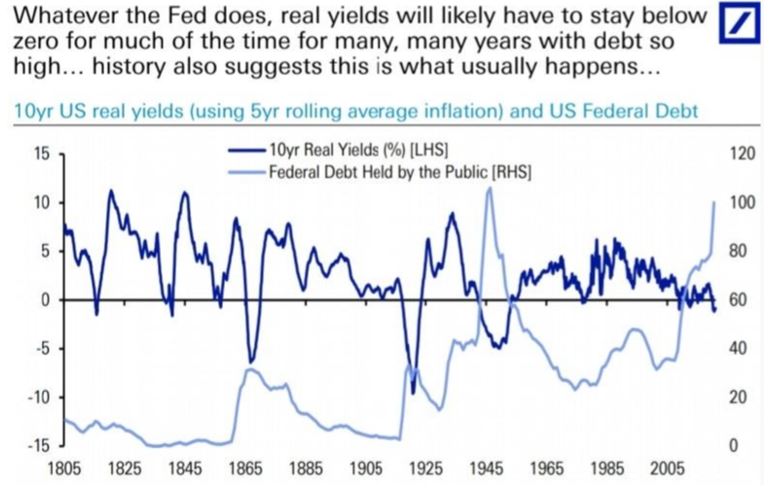

This graph from Deutsche Bank suggests that whatever the Fed does, real yields will likely remain below zero for years to come because of government debt being so high after COVID related stimulus measures. History confirms this relationship.

Broadly speaking, lower bond yields are supportive for equity market valuations, especially for higher growth names. As such we remain positive on equities as they near all-time highs. Although we acknowledge that after a strong recent run, there may be some volatility ahead, we continue to see opportunities in select growth names.

–

Monday 28 June 2021, 5pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.