Key economic releases last week

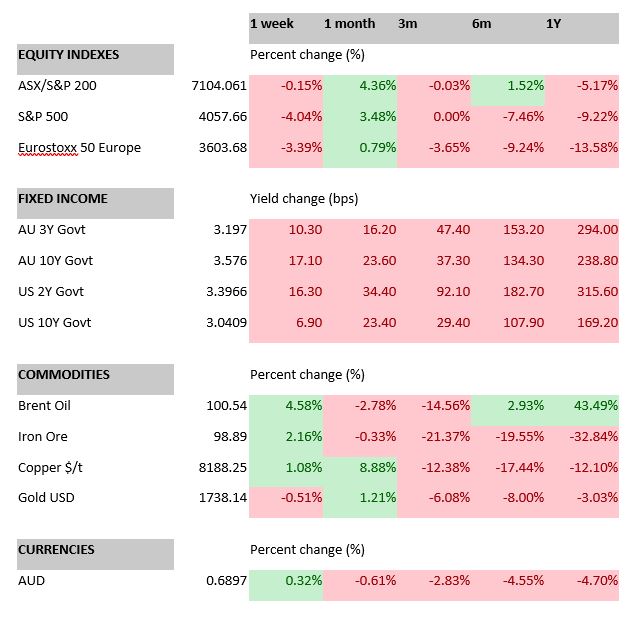

- Global preliminary PMI readings were weaker than expected, with many moving into contractionary territory. This is in-line with our outlook as the risks of a global recession continue to rise, hence we continue to maintain a conservative stance within our models.

- US PCE indicators were below expectations, with the core reading rising 0.1% MoM/4.6% YoY as data continues to indicate that inflation is now easing.

- Jerome Powell indicates rates to remain in restrictive territory for some time to fight inflation at the end of the Jackson Hole symposium.

- China’s central bank cuts its 5-yr loan prime rate by 0.15% to 4.3% and 1-yr loan prime rate by 0.05% to 3.65%. China also announced an additional USD146b stimulus plan, 30% will go towards further infrastructure spending while 50% will go towards local governments to spend. Given the incremental approach being taken, we expect Chinese policy measures to be supportive of commodity prices rather than drive a new surge. Given the rebound in miners, we turn more neutral on our outlook for the sector.

Key releases for the week ahead

- Australian retail sales

- US Consumer confidence

- Chinese PMIs

- US employment data

- EU inflation

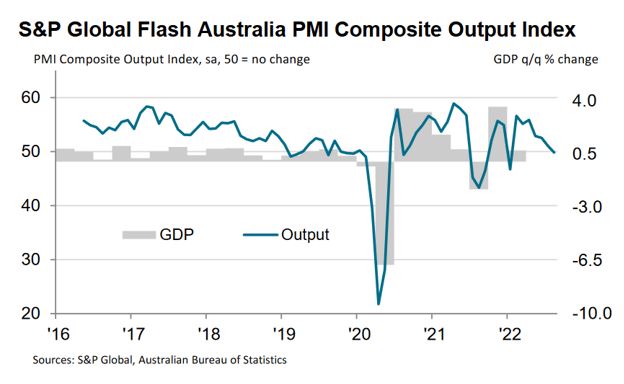

Chart of the week

The preliminary reading for the domestic Purchasing Manager Index (PMI), a key indicator for the economy, fell marginally below 50 and into contractionary territory for the first time since January. While we had expected the domestic economy to be more resilient than major global peers, the PMI reading indicates that we may have been optimistic, although the underlying components of this reading paints a less pessimistic picture as the survey showed price pressures were easing while new orders grew. Regardless, we have already moved to a conservative position within our model portfolios in anticipation of a deteriorating global economy.

–

Monday 29 August 2022, 10am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.