Global share markets sold off to end the week, suffering one of their most significant daily drops in more than twelve months. Investors were spooked by reports of a new COVID-19 variant with concerns that it could stall the global economic recovery.

The Australian S&P/ASX 200 fell 1.6% last week. The best performer was the Utilities sector which rose 2% as investors bought up safe-haven assets. The worst performer was the Information Technology sector which finished the week down 6%. Travel stocks were particularly hit hard with concerns of resurgent COVID-19 cases in Europe and the US, as well as news of the Omicron variant.

Overseas equity markets also sold off on the concerning news, with the S&P500 falling 2.5% for the Thanksgiving holiday-shortened week. Commodity markets were also impacted, with Brent Oil selling down 12% to US$73 a barrel on concerns that the new variant could crimp demand. The US 10-year bond yield fell to 1.48%, with investors seeking the safety of US bonds.

While markets have sold off significantly, there is little yet known about the potential impact of the Omicron strain and markets have been cautious given the impact of the Delta strain. We prefer to wait for more data before looking to draw any conclusions and making major pivots in the portfolios at this stage.

In economic news, Jerome Powell was nominated for a second term as the US Federal Reserve chair. President Biden’s choice to stick with the status quo should provide stability at this critical phase of the US economic recovery. The Reserve Bank of New Zealand and the Bank of Korea raised rates for a second time to counter inflation concerns. Preliminary readings of Purchasing Manager Indices for many major global economies indicated increased growth momentum. Retail sales and payroll jobs improved in Australia with NSW and Victoria reopening.

Fisher & Paykel Healthcare (FPH) posted a slight fall in 1H22 revenue and net profit in company news. It was a strong result given that the comparison period in 2021 included a pandemic led surge for its products during the early stages of COVID-19. Management expects to invest NZD700m over the next five years in land and buildings for manufacturing expansion to meet higher demand, demonstrating that the company is well placed to leverage a more extensive installed base and increased product awareness in the coming years. However, like any significant capital expenditure projects, these plans come with some execution risks that we will continue to monitor.

Ramsay Healthcare (RHC) held its Annual General Meeting during the week and provided positive commentary that COVID related disruptions to activity levels are starting to decline. Underlying demand remains strong, and there are large backlogs of elective surgery procedures. Management flagged that it would fast-track its investment plans to expand capacity to help address the backlog in surgeries and meet this pent-up demand. While concerned about the latest news of the variant, it is too early to assess the impact this may have on Ramsay’s operations in FY22. We continue to view the company as well run and well placed to grow earnings over the coming years.

Woodside Petroleum (WPL) announced a binding agreement for the merger with BHP Petroleum. Synergies are estimated to be $USD400m per annum, with completion of the merger expected in Q2 2022 subject to shareholder approvals. Woodside also announced the decision to proceed with the $16.5 billion Scarborough LNG project in Western Australia. We view natural gas as playing a necessary role as a low-carbon energy source, supporting the global transition to net zero carbon emissions.

For the week ahead, Australia September quarter GDP is expected to show a decline reflecting the extended NSW, Victorian and ACT lockdowns. US November jobs data is expected to show a further fall in unemployment. The release of Eurozone inflation data, confidence readings, and Chinese business conditions data will also be important for the market.

COVID developments

Just as it felt like life was getting back to normal, COVID concerns have again spooked the market.

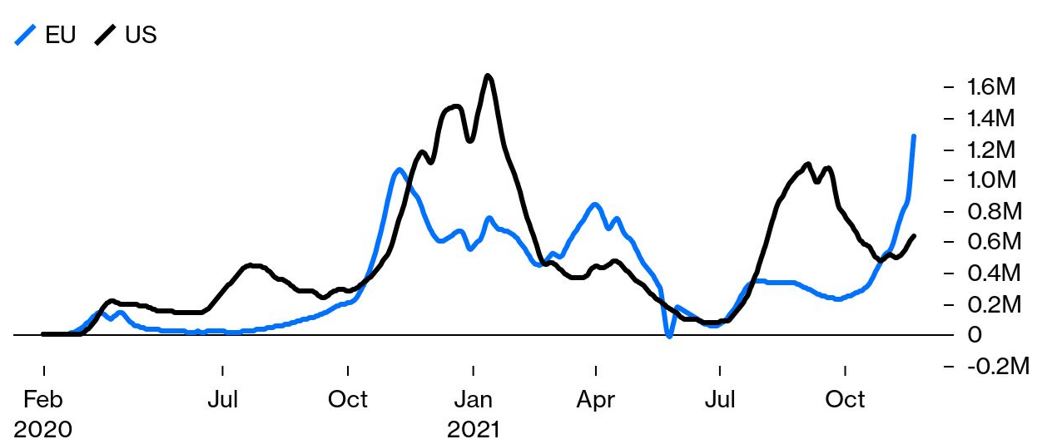

Europe is experiencing its highest number of confirmed cases yet, forcing restrictions in various countries, including lockdowns in Austria. Other countries, including EU powerhouse Germany, have warned that they may follow Austria’s lead should their healthcare system become overwhelmed. The chart below from Bloomberg Opinion shows the five-day rolling average of new cases, with the US figures multiplied to match the EU’s higher population.

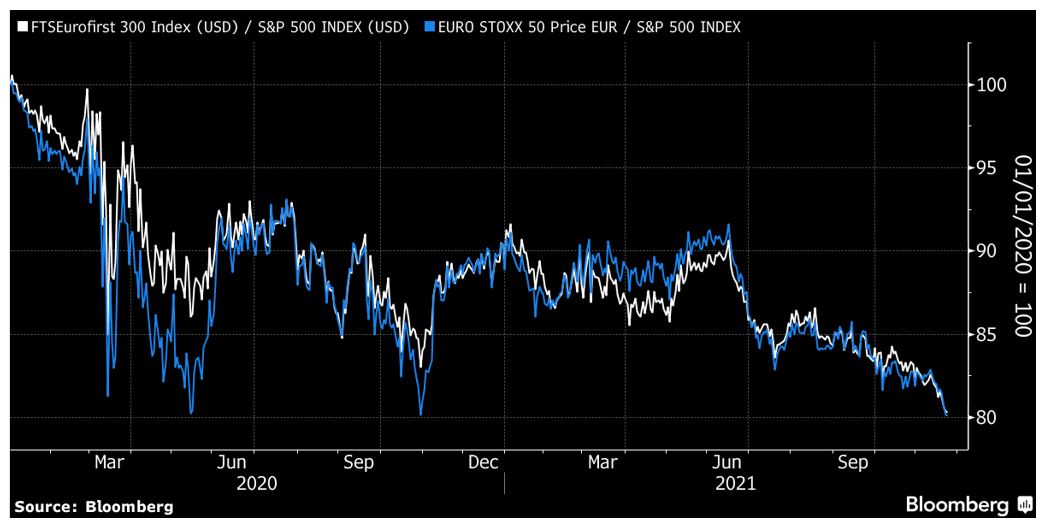

Virus concerns have real impacts on the EU stock markets, which are now trading at a new COVID low relative to the US S&P500.

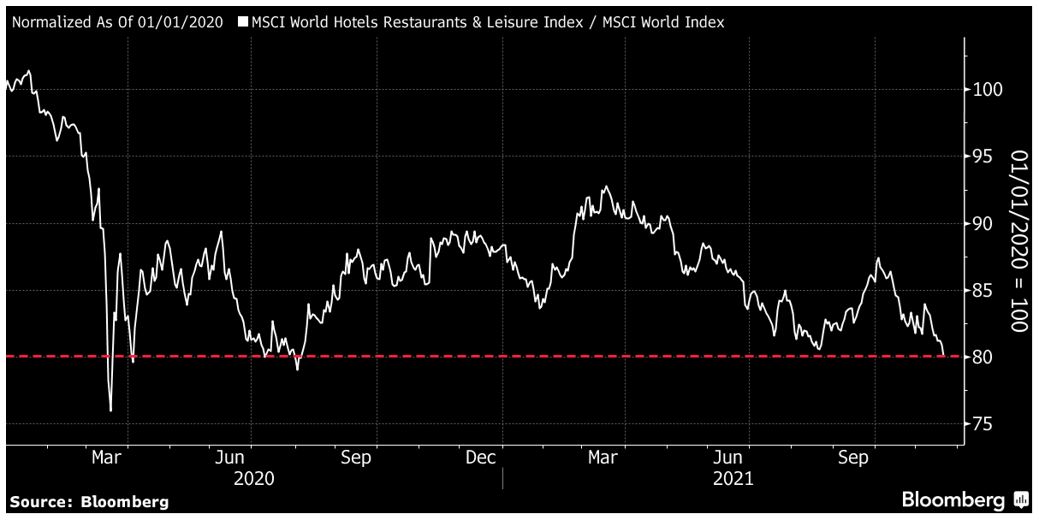

In the last week, news about the worrying new Omicron variant led to a global sell-off for risky assets and a flight to safe-haven assets. Travel and leisure stocks were hit particularly hard as investors fretted about the potential lockdowns and closed international borders. Global leisure stocks are now at a 12-month low relative to the market.

The latest developments serve as a reminder that the pandemic is not over and will remain an issue for investment markets for the foreseeable future. We will avoid any knee jerk reactions to our portfolios until more information is available on the implications of the new variant. Over the last two years, markets rewarded investors for taking a longer-term lens when assessing the latest virus developments. We expect markets to remain volatile until detailed scientific data emerges over the coming weeks. And this near-term volatility may present opportunities to purchase high-quality companies on a discount whose medium-term thesis remains intact.

The latest developments serve as a reminder that the pandemic is not over and will remain an issue for investment markets for the foreseeable future. We will avoid any knee jerk reactions to our portfolios until more information is available on the implications of the new variant. Over the last two years, markets rewarded investors for taking a longer-term lens when assessing the latest virus developments. We expect markets to remain volatile until detailed scientific data emerges over the coming weeks. And this near-term volatility may present opportunities to purchase high-quality companies on a discount whose medium-term thesis remains intact.

–

Monday 29 November 2021, 3pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.