Equities were dragged lower by poor reactions to earnings reports from the mega tech firms including Alphabet (Google’s parent company), Amazon and Apple. Earnings misses and weaker than expected guidance are being severely punished as the market continues to shun high growth, high valuation names in a rising rate environment. Earnings season as a whole has been decent, with 80% of companies beating consensus estimates but that did not support the market as the S&P 500 fell 3.3% for the week, with most of the losses coming on Friday night. The MSCI World fell 2.5% while the S&P/ASX200 was a relative outperformer, falling 0.5%.

Technology (-1.7%) continues to lead losses while Energy (-1%) and Materials (-1.1%) also performed poorly as worries over China’s growth continue with lockdowns. The best performers for the week were Utilities (1.3%) and Industrials (0.8%).

Bond yields were largely steady with the Australian 10-year government bond yield remaining at 3.12% despite higher-than-expected domestic inflation figures. The Consumer Price Index rose 5.1% over the 12 months to the end of March, well above estimates of 4.6%. Meanwhile, the U.S. 10-year Treasury yield ended the week at 2.89% as U.S. consumer confidence fell further and preliminary GDP readings showed a contraction of -1.4% for the U.S. economy, relative to consensus estimates for 1% growth.

The Bank of Japan met last week and remained at odds with other major central bank counterparts, reiterating its commitment to unlimited quantitative easing and pledging to keep 10-year Japanese government bond yields near 0%. Meanwhile, Chinese authorities have vowed further policy support to achieve growth targets, with infrastructure development a key focus, but the size and extent of support remains to be seen. Investment markets showed little reaction in response, indicating that ongoing lockdowns and the zero-COVID strategy remains the key hurdles for confidence to resume. Chinese purchasing manager indices (PMIs) survey results released over the weekend did little to assuage fears as both manufacturing and services readings fell deeper into contraction.

This week is huge for investment markets as the U.S. Federal Reserve holds a policy meeting and is expected to raise rates by at least 0.5%. The Reserve Bank of Australia also has a meeting on Tuesday afternoon and, after last week’s blowout inflation reading, is also expected to raise rates. We will also see U.S. employment data and PMIs from the U.S. and Europe.

The global economy is a growing concern

Markets are getting jittery. While the selloffs earlier in the year have been attributed to inflation worries and hawkish central banks, the past week has had a bit of a different flavour as bond yields largely held steady while equities took another step lower.

China’s PMIs over the weekend were terrible, signalling significant economic slowdown. As one of the two largest economies in the world by far, there is bound to be contagion for other countries if China enters a more prolonged economic slowdown. European growth has seen downgrades due to soaring energy prices and elevated uncertainty due to war while many developing countries have been hit with civil unrest skyrocketing food prices.

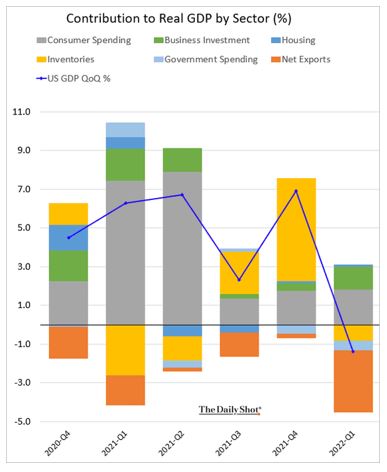

Added to this are headlines that the U.S. economy, thought to be resilient from high savings levels and a return to normal, saw a contraction in the first quarter, based on preliminary real GDP results.

While the reading was a big disappointment at the headline level, there were several factors that indicate things aren’t as bad as it looks. As the graph below shows, the drawdown was driven by a blowout in net exports whilst longer term drivers of the economy, consumer spending and business investment, continued to grow strongly.

Further to this, the prospect of large stimulus promised by Chinese authorities in order to meet growth targets, resilience in PMIs of many other Asian countries despite the weakness in China, and a strong domestic economy all offer some hope that global economic growth can prove resilient in the coming months.

This gives some comfort that, while the global economy is a growing concern, economic growth remains resilient which should lead to ongoing earnings growth which should help to support credit and equity markets. However, as always, we will continue to keep a close eye on economic developments as further weakening could result in an earnings recession which would place more pressure on markets already fighting the headwinds of rising costs and rising rates.

–

Tuesday 03 May 2022, 10.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.