Key economic releases last week

- NAB Business survey showed confidence remained weak while conditions are deteriorating and leading indicators continue to weaken further.

- Aus inflation readings were above estimates, with Q4 headline inflation at 1.9% and trimmed mean at 1.7%, both above estimates by 0.3% and 0.2% respectively. This brought the full year headline inflation rate to 7.8%, above the 7.5% consensus.

- US PCE and personal spending came in below expectations, further fuelling expectations for the Fed to moderate its hiking path. Headline PCE rose 0.1% MoM and 5% YoY compared to the 0.2% and 5.5% consensus, while core PCE was in-line with expectations at 0.3% MoM and 4.4% YoY, falling below the benchmark overnight interest rate. Personal spending fell 0.2% MoM compared to the consensus for -0.1%.

- Aus, EU, US preliminary PMI readings were mostly above expectations and improved from previous readings but remain in or close to contraction.

Key releases for the week ahead

- Australian retail sales

- US consumer confidence

- US ISM PMIs

- US employment data

- US Federal Reserve policy meeting

- China PMIs

- ECB policy meeting

- EU preliminary inflation data

- EU preliminary GDP

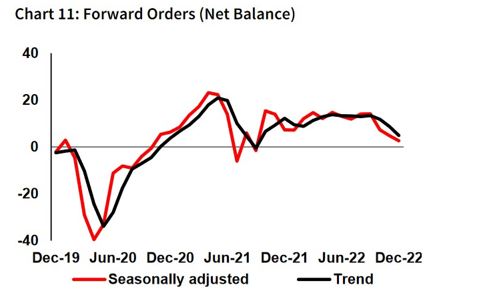

Chart of the week

Economic data has largely remained strong for Australia, as well as the US. However, a lot of the data focused on by the media are lagging rather than leading indicators. While lagging data is painting a picture that is supportive of a Goldilocks environment, leading indicators have been deteriorating for several months now. An example of this is the NAB business survey, where confidence has been below historical averages for a few months and conditions are now starting to deteriorate. The forward orders component is showing that demand is deteriorating after holding up for the majority of last year. We remain cautious on the outlook for the economy and earnings.

–

Tuesday 31 January 2023, 9.15am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.