Key economic releases last week

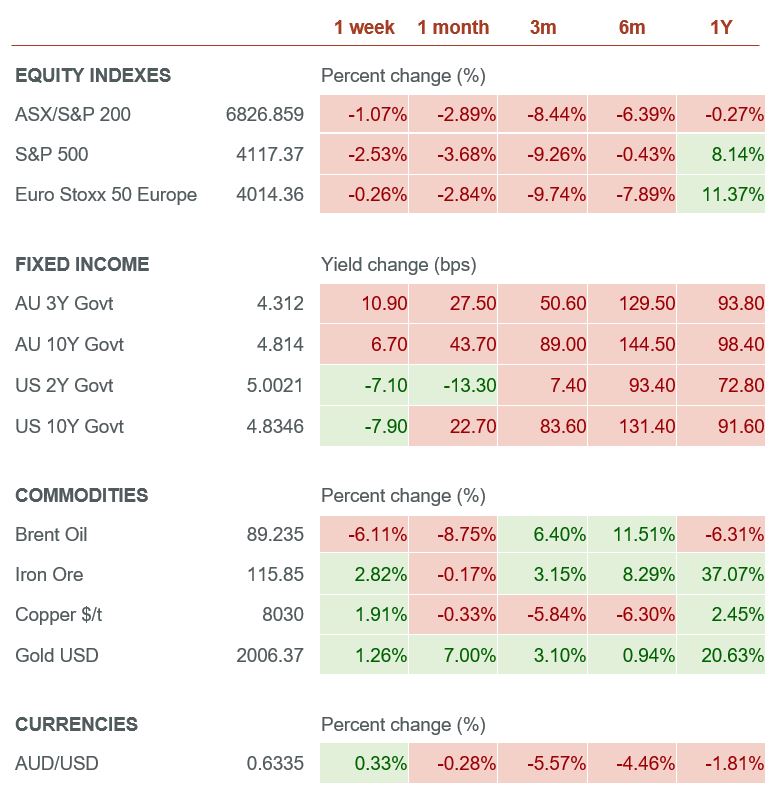

- Australian inflation data was higher than expected, rising 1.2% QoQ or 5.4% YoY, both 0.1% higher than consensus. The RBA’s preferred Trimmed Mean readings were 1.2% QoQ and 5.2% YoY compared to 1.1% and 5% respectively.

- Australian and EU preliminary PMI readings disappointed across both Manufacturing and Services, all weakening further and in contraction territory. US continues its resilience, with both Manufacturing and Services rising with Services remaining in expansion territory.

- US Core PCE was 3.7% YoY and 0.3% MoM, in-line with consensus. Headline PCE rose 0.4% MoM, 0.1% above consensus, though the 3.4% YoY reading was in-line.

- US personal spending rose 0.7%, more than the 0.5% consensus.

Consumer spending remains strong and has been outpacing wage growth. With excess savings from pandemic stimulus running out, we continue to see this as unsustainable. - ECB kept policy rates unchanged at 4.5% as expected.

Key releases for the week ahead

- Australian retail sales

- US consumer confidence

- US Federal Reserve policy meeting

- US employment data

- China PMIs

- EU inflation data

- EU Q3 GDP data

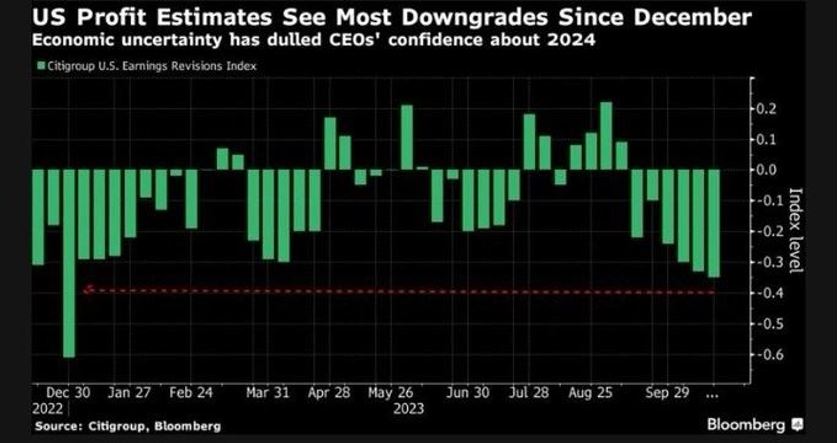

Chart of the week

We are about halfway through the quarterly reporting season for US equities. While earnings beats have been about in-line with historical averages, revenue beats have been slightly weaker. Despite the likely end of an earnings recession, equities overall have had a negative reaction as commentary on the outlook or guidance has not been as positive as hoped, driving earnings revisions lower.

Companies like META (Facebook) have cited an uncertain outlook and volatility in the macro landscape, while some like MA (Mastercard) gave disappointing guidance. While economic data has been resilient, expectations for future growth may be too high, or the consumer may be weakening as pandemic savings have evaporated, or higher costs (labour, funding or other) may be starting to bite.

While the recent sell-off has made valuations less expensive, we continue to be cautious as uncertainty remains elevated. However, we are seeing some pockets of the market starting to become attractive. We remain vigilant and proactive, looking to add to growth assets and reduce our underweight to risk as valuations become more attractive.

–

Monday 30 October 2023, 10.30am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.