Equities performed strongly last week with the S&P/ASX 200 gaining 2.1% and closing at a record high of 7179.5. Telecoms were the best performing sector (+3.6%) and utilities the worst performing (-1%). In the US, the S&P 500 closed 1.2% higher, securing the first weekly gain in the last three weeks. Global equities as measured by the MSCI World also rose 1.3%.

Economic data from both Australia and Europe continues to point to a strong recovery. In Australia, housing construction and business investment are on the rise, consistent with high levels of confidence in the economic recovery. Eurozone economic confidence rose to its highest level since 2018 on the back of the reopening services sector.

Data from the US was more mixed, with jobless claims continuing to fall but US consumer confidence and new home sales coming in below consensus. US consumer prices rose in April, with core PCE price index increasing 3.1% in the 12 months through April, caused by pent-up demand and supply constraints as the economy reopens. The Fed chairman Jerome Powell has continued to state that this higher inflation will be transitory.

In corporate news, Aristocrat Leisure (ALL) confirmed strong first half results and noted impressive momentum across the business, thought expect volatile conditions to continue in the near term.

Fisher & Paykel Healthcare (FPH) posted results slightly below market expectations. Management did not provide guidance due to ongoing uncertainties with COVID. Freight costs are impacting margins, and these are expected to continue to be a drag in the near term.

Appen (APX) hosted their AGM and again reiterated revenue and EBTIDA guidance. Global services expected to experience mid to high singled digit growth and new markets around 25% revenue growth. Management stated that key customer projects that were delayed in 2020 are returning with a skew to delivery in the second half, helping to boost revenue growth in the second half.

For the week ahead, Australia will release gross domestic product (GDP) data for the March quarter on Wednesday. Economists expect this data to show that Australia has more than offset all the lost output from COVID-19. In the US, we receive manufacturing and services conditions data and jobs data. Eurozone unemployment and core CPI inflation are both due to be released on Tuesday. Chinese business conditions PMIs will be closely observed given mixed recent economic readings from the powerhouse economy.

Relative calm

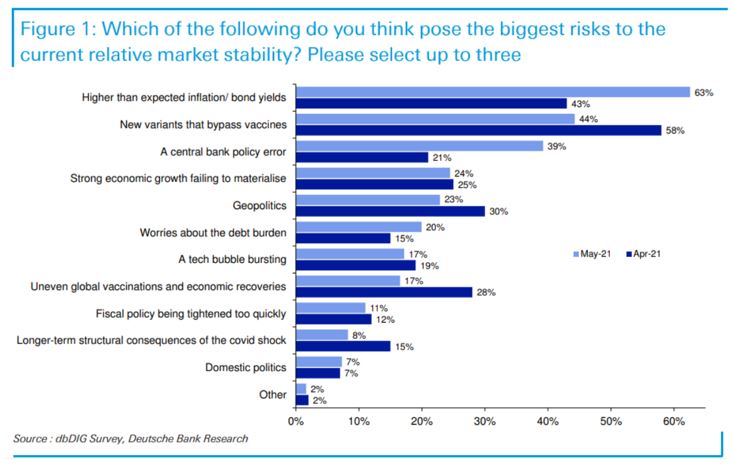

With the Australian share market hitting record highs last week, it is worth turning our minds as to what may disrupt the current calm in markets. Deutsche Bank conducted a survey in the US, asking participants to rank the greatest current risks to markets.

In May, higher than expected inflation and higher inflation leading to a central bank policy error were ranked as the greatest risks to markets. These overtook a new vaccine resistant variant of COVID-19 as the top risk.

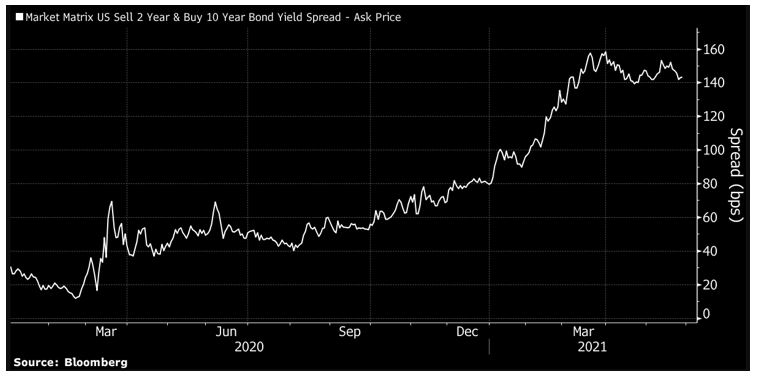

This survey demonstrates that inflation concerns will continue to be the key focus of investors in the near term. While upcoming inflation readings are expected to be higher, due to base effects and the economies reopening, the RBA and the Fed continue to believe these impacts will be temporary. Investors have tended to agree with central bankers with bond market yields have fallen slightly from March peaks.

Given the markets focus on inflation, we will continue to monitor future economic updates closely.

Should inflation data overshoot consensus and prove to be more structural, the relative calm of markets will be shattered, and volatility will return. In this case we would expect to see higher valuation growth equities sell off while some cyclical names will likely remain relatively resilient.

–

Monday 24 May 2021, 5pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.