Key economic releases last week

- Australian preliminary retail sales came in flat MoM compared to expectations for a 0.3% increase.

- US, EU, Australian preliminary PMIs were largely better than expected as Services remained strong and in expansionary territory, though Manufacturing remains in contractionary territory.

- US personal consumption expenditures price index rose 4.4% YoY while the core rose 4.7% YoY, both above consensus expectations. Both readings also rose 0.4% MoM, above the run-rate required to reach the Fed’s inflation target. As a result, bond yields are creeping higher again as resilient economic and inflation readings drive the market to lower expectations for rate cuts.

- US personal spending rose 0.8% MoM, more than the 0.4% consensus, underscoring a still resilient consumer. A JPM investor update also noted that household cash balances remain well above pre-COVID levels in the US, potentially driving a more resilient consumer.

- US preliminary Q1 GDP was revised higher to 1.3% QoQ, underscoring the resilience of the US economy over the last quarter.

Key releases for the week ahead

- US consumer confidence

- US employment data

- EU preliminary inflation

- China PMIs

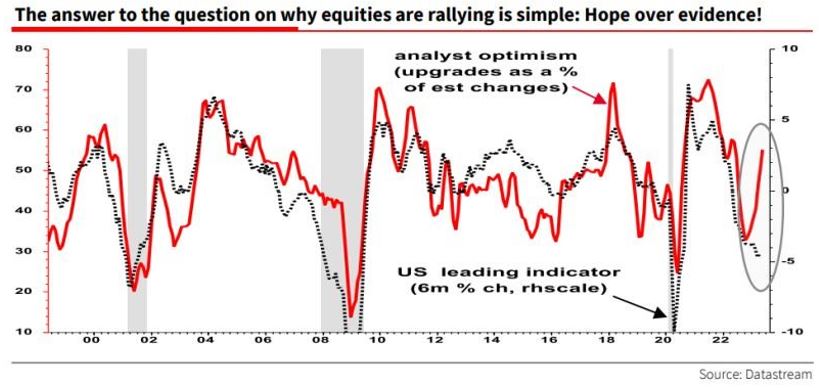

Chart of the week

Every month, the Conference Board releases the Leading Economic Index (LEI), which combines multiple indicators to assess the direction of the economy. These indicators include fluctuations in the S&P 500, unemployment claims, new manufacturing orders, yield curve measurements, and permits for new housing construction amongst others.

The above chart illustrates the comparison between the 6-month growth rate of the US LEI and aggregate stock analyst sentiment, specifically focusing on the balance between stock upgrades and downgrades. It is noteworthy that despite the declining leading economic indicators, stock analysts are displaying optimism by issuing more upgrades than downgrades in their forward earnings estimates. The current significant divergence between these two readings is unusual and, based on historical patterns, it suggests that more downgrades may be forthcoming to reflect the impact of a slowing economy. This may pose a challenge to the current market rally and helps clarify our current defensive positioning.

–

Wednesday 31 May 2023, 1pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.