Australian equities finished the week lower, with the S&P 200 falling 0.5% to end the week at 7,025. The best performer was the Utilities sector, up 0.6%. The worst performers were the Consumer Staples sector, down 3.4%, and the technology sector down 2.3%. Small companies underperformed larger companies, with the Small Ordinaries Index finishing the period down 0.9%.

The S&P 500 and the MSCI World were flat for the week, even with continued strong earnings results from US companies, led by the mega-cap technology stocks.

Biden confirmed an extra $1.8 trillion stimulus over ten years focused on childcare, education and paid leave. The bill will be partially funded by increasing income tax rates and capital gains taxes on high-income earners. This proposed plan will face legislative challenges and maybe diluted as it progresses through Congress.

Economic data from both Australia and abroad remains very positive and continues to point to a strong recovery. US GDP came in at an annualized 6.4%. Australian consumer price inflation came in weaker than expected at +1.1% year-on-year, boosting the chances that interest rates will remain low for longer. In Europe, there were substantial increases in consumer and business confidence.

Companies have been issuing trading updates for the quarter, with Westpac (WBC) announcing better than expected first-half results. First half cash earnings were $3.5 billion, up 256% on the first half last year as the economy rebounds from COVID-19. The results bode well for two of the other big four banks, ANZ & NAB, who also release interim results this week.

Coles (COL) announced Q3 revenue figures that were 5% lower than last years. However, the market expected this slowdown from last year’s pandemic induced pantry stocking. Importantly, consumers are returning to their regular shopping habits, doing more frequent shopping trips, heading back to shopping centres and CBDs, where Coles’ portfolio is focused. We believe this trend will assist Coles recapture the market share lost to Woolworths and IGA during the pandemic, who benefitted from more local neighbourhood stores that customers favoured.

IOOF (IFL) reported Q3 funds under management and administration were up $1.5 billion (0.7%) to $203.9B. Strong market returns offset net outflows.

Newcrest Mining (NCM) announced they are on track to achieve its production guidance. Q3 FY21 results were solid with 512koz of gold and 35.0kt of copper in concentrate, in line with estimates.

Downer (DOW) announced a share buyback for up to 70.1m shares, which equates to 10% of outstanding shares, using funds from recent asset sales. Their focus on high quality and strong cash conversion businesses moving forward lowers their risk profile. We expect multiples to rise over time.

Mirvac (MGR) announced better than expected residential sales and settlements, prompting Mirvac to upgrade its earnings expectations for the year to June.

Looking forward, we get Purchasing Manager Indices (PMI) readings from most major economies. PMIs are a key forward indicator for economic growth and have recently been riding a strong wave of recovery momentum. In the U.S., we get key data points for employment figures, which are expected to show further improvement with high economic confidence backed by strong vaccination numbers. China trade figures will also be released.

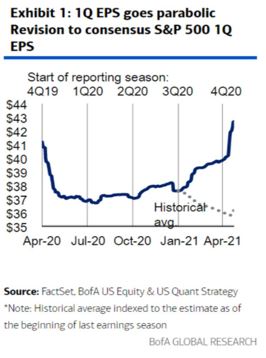

Record US EPS growth

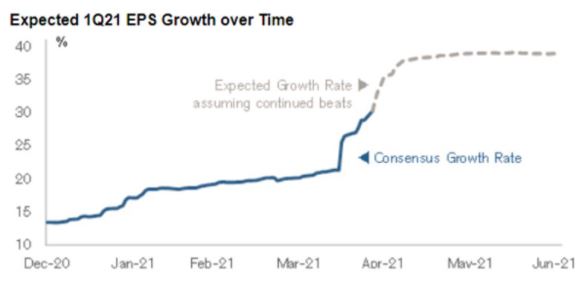

We are now well into the US Q1 2021 reporting season. Over half of the S&P 500 have now reported, with 86% having beat EPS estimates. Companies are reporting earnings that are beating estimates by a more considerable margin than the five-year average.

The index is now reporting the highest year-over-year growth in earnings since Q1 2010, led by cyclical companies hit particularly hard by the pandemic. This significant increase is due to both strong Q1 2021 earnings and weak comparison earnings in 2020.

The market has had a largely muted reaction to these impressive results, suggesting many expected strong results. Investors remain cautious about whether companies will continue to meet these elevated expectations in the months ahead.

–

Tuesday 04 May 2021, 4pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.