Both risk and defensive assets were lower for the week again. We have not seen a meaningful correction throughout 2021 and the drawdown in a seasonally weak September has not been too painful either as most major equity indices remain within 5% of recent highs. The S&P/ASX 200 was down 2.1%, largely in-line with the U.S. S&P 500 and MSCI World indices which were down 2.2% and 2.3% respectively. Growth sectors paced declines as the domestic healthcare and technology sectors were the worst performers, down 5.8% and 6.2% respectively. Energy fared best, rising 5.1% as the power crunch in China started to make headlines, and coal, gas and oil prices continued higher.

Yields continued to rise with the Australian and U.S. 10-years both close to 1.5% again as inflationary concerns return, with Europe posting inflation figures well over their objective range and the U.S. Federal Reserve Chair noting that inflation has been more persistent than earlier expected.

In economic news, domestic manufacturing remains resilient despite the lockdowns. Similarly, U.S. manufacturing indicators continues to hold up well at high levels. Supply chain issues have whittled down inventories in the face of strong consumption levels for goods. This could keep global manufacturing activity well supported for some time. The next leg for global economic growth as restrictions continue to ease would be a recovery in the services sector, which remains well below pre-pandemic levels. The outlier was China, with Chinese manufacturing falling into contractionary levels as the power shortage starts to impact factories. The flipside to this was a rebound in services as recent lockdown measures eased.

Turning to corporate news, Sigma Pharmaceuticals (SIG) has launched a rival bid for Wesfarmers (WES) target Australian Pharmaceutical Industries (API), with API stating that the SIG bid would likely be more favourable for shareholders than the WES offer.

Elsewhere, OZ Minerals (OZL) disclosed a resource discovery that it has rights to within the Carajas region where it already has several projects, and Ramsay Healthcare (RHC) provided an update on the restrictions for its Australian hospitals. This was largely within expectations and the company remains of interest to us, though it is not currently in our models.

Key data this week are job advertisement and business confidence readings. Overseas, U.S. employment data will continue to be watched closely, especially with the supplement to federal unemployment benefits rolling off. Investors will also continue to watch for any progress on the infrastructure bills and a longer-term solution for the U.S. debt ceiling.

The energy conundrum

Interest in the energy sector has bubbled up in the past couple of weeks due to the reported power shortages in China and the Brent crude oil price recently topping U.S. $80 per barrel. Natural gas, seen as a key transition fuel given much lower carbon emissions relative to oil and coal, has risen a whopping 150% over the past two years.

There is no doubt that renewables will continue to make up a larger portion of global energy supply, but it is impossible for fossil fuels to be replaced overnight. Even with huge amounts of stimulus and policy support, building solar, wind and hydro farms require time and resources on top of huge amounts of investment. As a result, fossil fuels will continue to be essential for years to come.

The push to wean ourselves off fossil fuels has had several profound impacts on the sector. Capital investment has been shunned as banks look to shrink their exposure to the sector to improve their ESG scores whilst many investors have avoided the sector, leading to higher costs of capital for the energy companies themselves. As a result, development of new production has fallen and demand growth is forecast to outstrip supply growth. This should lead to higher prices for fossil fuels in the medium term while we wait for renewables supply to close the gap.

We have already seen fossil fuel prices rise above pre-pandemic levels, a stark contrast to just 18 months ago when oil futures just briefly turned negative. Natural gas should be a bigger beneficiary as a lower carbon option, and we have seen this in the price.

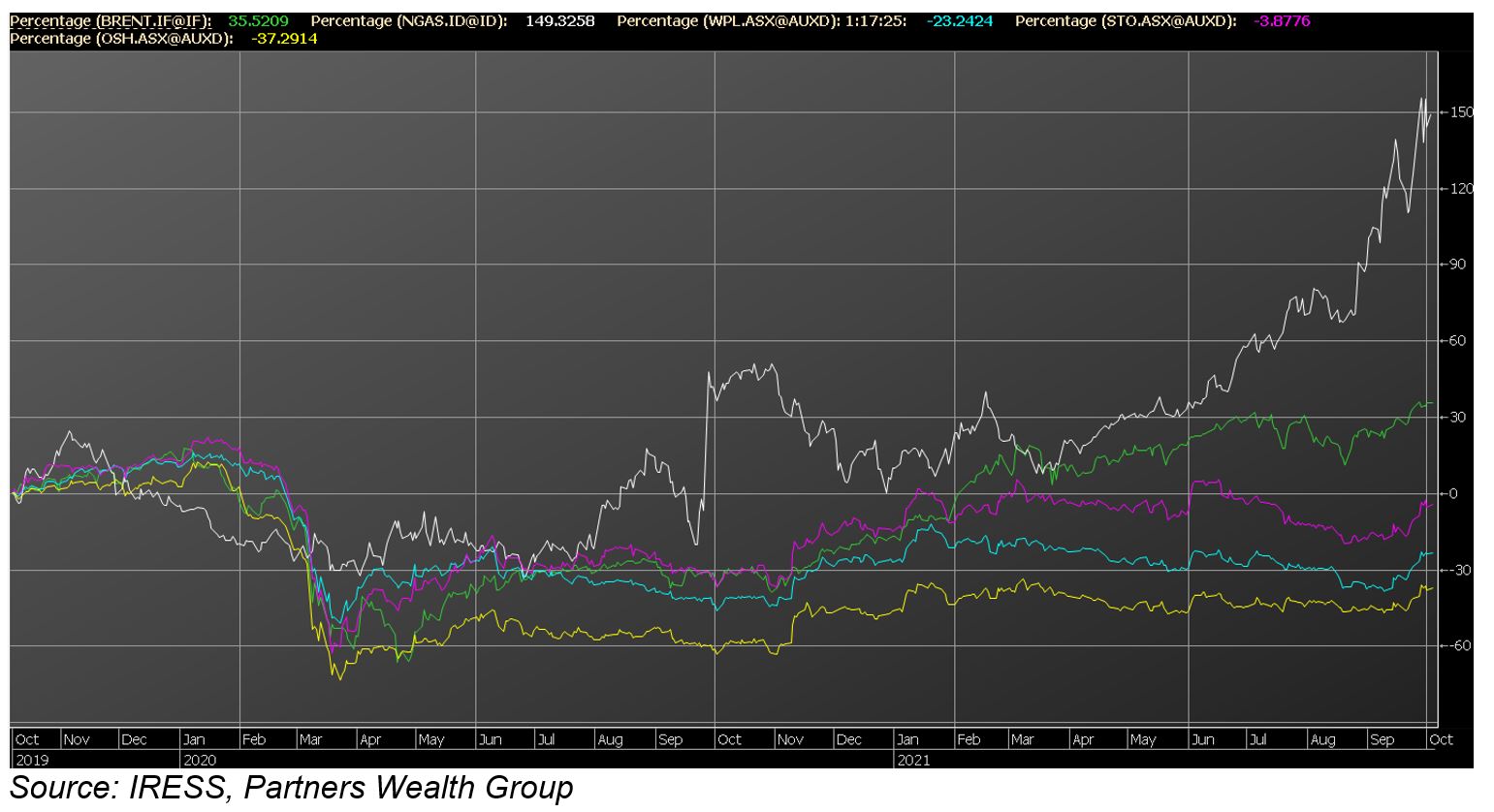

The chart below shows Brent crude oil price in green and Nymax natural gas futures price in white compared to the major ASX-listed players, Woodside Petroleum (WPL) in teal, Santos (STO) in purple and OilSearch (OSH) in yellow over the past 2 years.

While both commodity prices are well above their pre-pandemic levels from two years ago, STO remains slightly lower, while WPL and OSH are languishing more than 20% below October 2019 levels. All three have underperformed global peers who are seeing stellar returns. For example, the best performing sector in the U.S. S&P 500 this year is energy. Meanwhile, the S&P/ASX 200 energy sector has underperformed broader index. Furthermore, the three stocks highlighted are predominantly natural gas producers.

As a result, we think that there is a dislocation and potential opportunity for investors, hence we have a position in our models in WPL. While renewable energy is the future, natural gas is the most environmentally friendly fossil fuel bridge to that future and makes up 80% of WPL’s sales.

–

Tuesday 5 October 2021, 12pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.