Key economic releases last week

- Australian retail sales rose 0.9% MoM, far exceeding consensus expectations for 0.3% growth as consumers remain resilient.

- US consumer confidence declined to 102.6, remaining in positive territory and above consensus estimates.

- US Federal Reserve kept rates on hold at 5.5%.

- US employment data was weaker than expected, with nonfarm payrolls rising 150k compared to the 180k consensus estimate. The unemployment rate ticked 0.1% higher to 3.9% while earnings rose 0.2% MoM or 4.1% YoY. Job openings rose compared to consensus for a fall in the number of jobs available.The data indicates that employment remains solid but continues to weaken at the edges, continuing to support the case for a ‘soft landing’.

- China PMIs disappointed as Manufacturing fell back into contraction territory while non-Manufacturing fell to 50.6 compared to consensus at 51.8.

- EU headline CPI was better than expected, rising 0.1% MoM and 2.9% YoY compared to consensus respective estimates of 0.3% and 3.1%. Core CPI was in-line at 0.2% MoM or 4.2% YoY.

- EU GDP fell 0.1% QoQ in Q3 or an anaemic 0.1% YoY growth.

Key releases for the week ahead

- ANZ Australian job ads

- RBA policy meeting

- China trade data

- China inflation data

- China loans data

Chart of the week

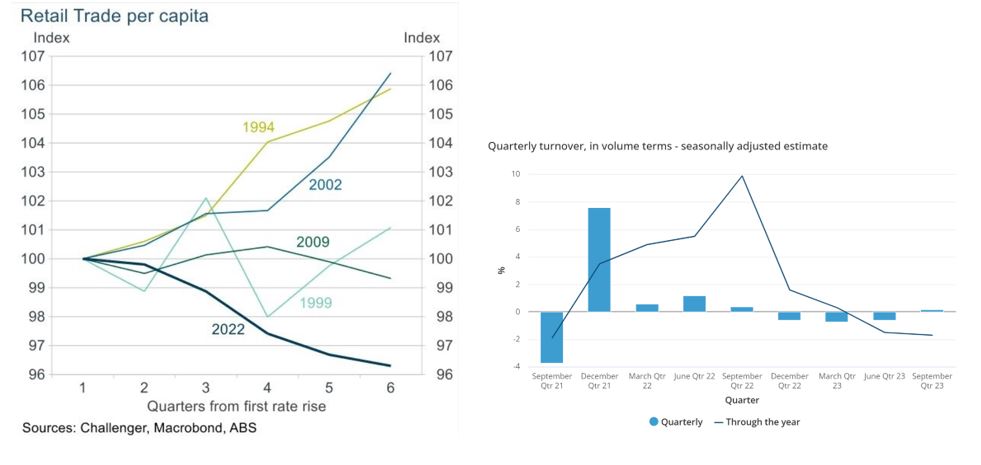

In September 2023, Australian Retail Sales surprised by increasing 0.9% month-on-month and 2% since September 2022, implying the economy’s resilience despite the RBA’s 400bps rate hikes. Retail Trade data measures total retail turnover for Australian businesses, focusing on overall demand. On a per capita basis, average Australian household spending on retail trade is now 4% lower than when the RBA started raising rates in May 2022. However, population growth has more than compensated for this decline at the headline level.

Rising component prices contribute to headline sales, but quarterly turnover in volume terms has been negative over the past year, even considering population growth. In summary, households are cutting back on spending, aligning with the RBA’s intentions to cool the economy, and with recent talk of further rate hikes, this raises the risk of potential over-tightening by the RBA. Reflecting these concerns we remain underweight retailers in our portfolio for now.

–

Monday 6 November 2023, 6.30pm

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.