Weekly Market Update

Markets rebounded from the previous week’s mild sell-off as strong earnings came to the fore and the Gamestop fiasco faded into the background as the stock tumbled. Retail traders supposedly turned their attentions to silver, whilst cryptocurrencies made new highs. The U.S. S&P 500 rose 4.7% whilst the S&P/ASX 200 rose 3.5% as risk-on sentiment returned.

With more than half of the S&P 500 having reported, the strong rate of earnings and revenue beats continues at 81% and 79% respectively. At this rate, the earnings growth for 2020 for the S&P 500 would amazingly be positive despite the pandemic. Large cap tech’s strong results across the board including Alphabet (GOOG) and Amazon (AMZN) this week underpinned the leadership rotation back to the growth sectors.

The domestic earnings season is also ramping up, with Amcor (AMC) and REA Group (REA) both beating estimates. AMC upgraded guidance again as we expected, with guidance for a 10-14% growth in constant currency earnings for 2021, up from 7-12%. Synergies from the Bemis acquisition continue to impress, whilst raw material costs remain well controlled. On current exchange rates, AMC is trading at around 16x P/E at the low end of guidance. To us, this remains attractive relative to the broader market, especially for such a resilient company.

REA also beat estimates with a 13% rise in profit as it noted that the “property market is on the march again”. Listings were flat in January whilst REA continues to see strong levels of buyer enquiry. Revenues fell 2% versus the previous year, driven by a 26% decline in commercial and developer revenue, though largely offset by the strong residential market which increased 4% and is roughly 2/3rds of REA’s sales.

Elsewhere, Magellan Financial Group (MFG) posted an update for funds under management, with a dip from $101.37 billion to $100.41 billion despite net inflows of $223 million, primarily driven by a fall in infrastructure assets.

Economic update

Global economic data was mixed as Chinese Purchasing Manager Indices were disappointing as recent new cases sparked new restrictions and there were indications over the past few weeks that Chinese authorities were draining liquidity from the market as they look to control the risk of speculative excesses building. Whilst both services and manufacturing readings remain in expansionary territory, both readings have been weakening.

Over in Europe, the trend for a resilient rebound in manufacturing and weak services activity amidst the continued high number of daily new cases continues. Meanwhile, inflationary readings have shown nascent signs of a recovery.

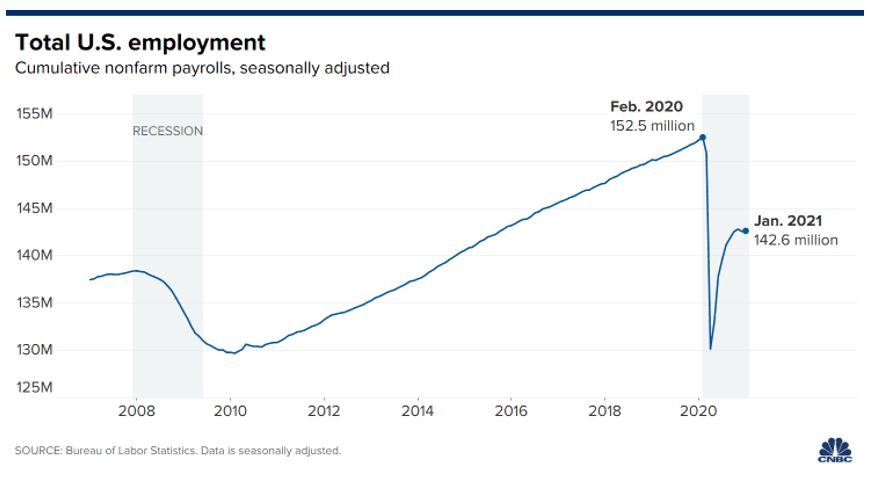

In the U.S., both manufacturing and services remain surprisingly strong. Importantly, the employment segment of the surveys for both have strengthened again, pointing to a possible resumption of recovery in employment. It was still too early to tell though, as U.S. employment posted a meagre 49,000 new jobs, primarily driven by government hiring. The unemployment rate fell to 6.3% as the participation rate fell, but employment remains almost 10 million below pre-pandemic levels.

The domestic economy remains on sounder footing, with both manufacturing and services indicators maintaining a strong momentum as the rebound continues. Job ads grew 2.3% again and now sits about 5.3% above the pre-pandemic level. Building approvals were up 10.9% with strong increases across the country. Business conditions were also very strong for the final quarter of 2020. Things look good across the board for now.

Quantitative easing becomes a relative game

The economy and market also remain well supported, as the Reserve Bank of Australia (RBA) added an extra $100 billion to its asset purchase program that was set to end in April. This will extend its program for another six months to October. Governor Lowe also said that there would be no increase in the cash rate until actual inflation is sustainably within the target range of 2-3% which would require wage growth to be materially higher than current levels and significant gains in employment. The RBA does not expect this to be the case until at least 2024.

Further to this, the RBA officially stated that QE has become a relative game. This came in a single paragraph in Governor Lowe’s speech,” In terms of other central banks, most have recently announced extensions of their bond purchase programs, many running until at least the end of this year. Given this, if we were to cease bond purchases in April, it is likely that there would be unwelcome upward pressure on the exchange rate”. This is significant as more QE may be forthcoming post the completion of the current $200 billion program expiring in October. With Europe, U.S. and Japan likely to continue their QE programs through to 2022, it could mean that the RBA would continue to add another $200 billion to the current program to extend it to late next year. This is a significant sum and would bring the RBA balance sheet to around 50% of GDP.

This also begs the question as to whether this ends up in another spiral as economies look to weaken or maintain their currencies against one another. Whilst these QE programs will likely help markets higher and keep a lid on yields in the near term, continuous expansion may have huge ramifications for the structure of financial markets and cause speculative excesses to form, potentially setting up the next great financial crisis. Only time will tell, but for now, markets remain focussed on a recovery in both earnings and the global economy.

Looking ahead, the U.S. earnings season is heading into its final stretch, whilst the Australian earnings season is just starting to build steam. Markets will also be focussed on U.S. stimulus progress as the Democrats push forward with a budget resolution that will help to fast-track their $1.9 trillion stimulus plan, whilst some Republicans have opposed such a large bill and tabled a $618 billion plan.

–

Monday 8 February 2021, 11am

For more information on the above please contact Bentleys Wealth Advisors directly or on +61 2 9220 0700.

This information is general in nature and is provided by Bentleys Wealth Advisors. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decision based on this information.